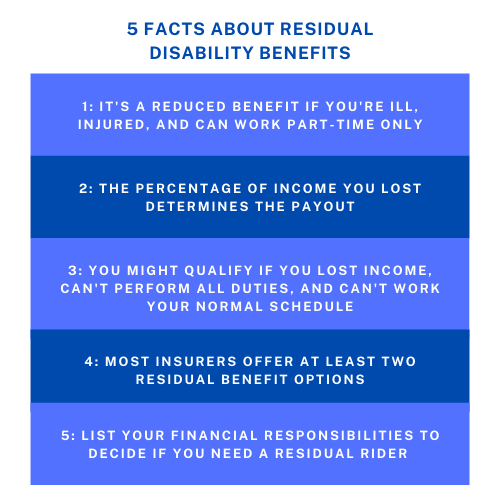

Disability income insurance replaces a portion of your income if you are ill or injured and unable to work. Some disability insurance plans offer residual benefits even if you are sick or injured but can still work part time. What is residual disability income? And how are payments calculated?

1. What Is a Residual Disability Income Payment?

A residual disability income payment is a reduced benefit based on a percentage of your lost income if you can only work part time due to an illness or injury. Your insurer may offer an add-on feature, called a partial disability rider, that allows you to purchase the option to receive partial income replacement if you can still work part-time.

According to Bureau of Labor statistics, in 2019, 32 percent of workers with a disability worked part time, compared with 17 percent for those with no disability. So, for many families, a residual disability rider is worth considering.

2. How Are Residual Disability Income Payments Calculated?

Residual disability income payments are calculated based on the income you are losing if you can only work part time. You will receive a percentage of the total monthly disability benefit stated in your policy. In many cases, if your income loss is greater than 75%, the insurer will pay you 100% of your monthly disability insurance benefit.

For example:

- Your disability income insurance payment is $3,000 per month for full-time disability.

- You purchased a residual disability income rider.

- After an illness or injury, you can only work 40% of your full-time schedule.

- Depending on your policy, the residual payment will be approximately 60% of $3,000 (total monthly benefit) or $1,800 per month.

3. Do You Qualify for Residual Disability Income?

You might qualify for residual disability income if your disability insurance automatically includes residual disability benefits or if you purchased a rider for it.

Although you must read your policy and contact your insurer to confirm eligibility, you might qualify in these circumstances:

- Loss of income: As a result of your disability, your work schedule is reduced, and you lost income.

- Unable to perform all duties: You are unable to complete some of your job responsibilities.

- Unable to work your full schedule: Your disability prevents you from working the same number of hours as before your illness or injury.

4. What Are Your Options for a Residual Disability Rider?

Many insurers that offer a residual disability rider have at least two options to choose from—basic and enhanced. As expected, the cost of the rider increases with the level of benefits it provides.

- Basic – A basic rider usually requires a significant percentage of lost income before you can receive partial payment.

- Enhanced – An enhanced rider reduces the percentage of lost income you must experience before benefits are paid. And an enhanced rider offers more benefits overall.

5. Do You Need a Residual Disability Rider?

Whether or not you need a residual disability rider depends on your unique circumstances.

Some factors to consider:

- Amount of your savings

- Number of your dependents

- How a disability would affect your work performance and the physical or mental requirements for your job

- Your living expenses and any debt

- How much disability income insurance you need or already have

Interested in NC Disability Income Insurance?

If you live in North Carolina and are interested in disability income insurance, contact Hunt Insurance of Raleigh. We will give you personalized service and thorough answers to help you decide if disability insurance is right for you.