Your environment, peers, family background, and other factors can affect your spending habits. But are you a debtor, a wealth creator, or another type of spender? Did you realize that the way we choose to pay for items can have more of a long-term financial impact than what we buy? We will discuss how major capital purchases can affect your wealth. And you will learn to identify the type of spender you are and how it affects your wallet.

What Is a Major Capital Purchase?

A major capital purchase is something we buy but cannot pay in full, so we must finance it. Cars, weddings, a new roof on our home, or vacations are significant expenses for many Americans. And they pay for them with a credit card or another type of financing. For many consumers, the result of some major capital purchases is owing creditors more than they accumulated.

What Is Your Buying Profile?

Your buying profile is the way you spend money and make purchases. Spending habits vary. But are you the type to pay with a credit card, save money until you can pay cash, or are you a wealth creator who tries to find a low-interest loan?

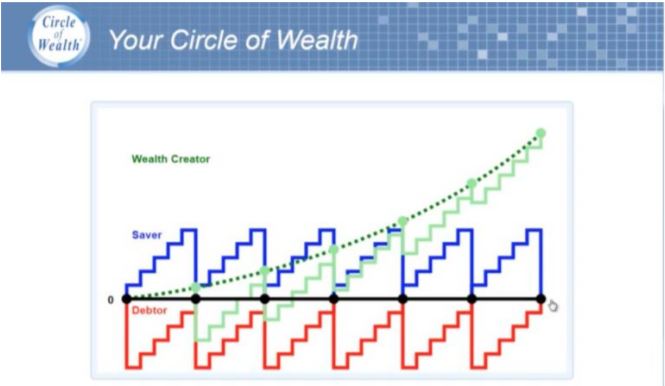

Consider the graph below:

Spending Habits and Wealth Creation: Revealing Facts

Each line on the above graph is described below with a buying profile that describes spending habits to help you identify your buying profile. And the profile will help you understand if you are on track to becoming a wealth creator. Can you identify your profile?

1. Zero Consumer

A zero consumer is a person who neither has nothing nor owes anything. The black line in the graph represents the zero consumer. But whenever you owe more than you own, it positions you below the zero line.

2. The Debtor

A debtor is someone with no savings or resources who must borrow to pay for expenses. The debtor’s spending habits often involve borrowing money against future earnings and working to pay them off to rise above the red line and return to the zero line. If you are a debtor, you financial advice can help you get out of debt.

These factors also characterize the debtor:

- Working to pay off debt before another need arises

- Spend life working to pay off debt with interest

- Depend on future earnings to support their lifestyle

- Loss of control of resources, because creditors control them, not you

3. The Saver

A saver is a person who remains aware of the costs of borrowing at interest. Rather than spending money they don’t have, a saver postpones purchases until they have enough money to pay upfront. The saver pays with cash—in full. The blue line in the above graph represents the saver.

What are the effects of a saver’s spending habits?

- Consuming their savings for major purchases that move them closer to the zero line.

- Continuously moving through a cycle of having access to money then needing to spend their saving.

- Draining savings accounts to avoid paying interest.

Although saving money to pay with cash seems to be the best way to pay for things and avoid interest, it has some disadvantages:

- Eliminates the ability to earn interest on savings

- Requires saving money—and that takes time

- Often becomes taxable income

- Increase risk of draining savings on a major or unexpected event

4. The Wealth Creator

The wealth creator takes responsibility for creating wealth through an approach that saves and spends money while still earning interest and not depleting income. Represented by the green line in the above chart, the wealth creator has unique spending habits. They save and use savings as collateral for a loan with lower interest than the interest rate on their savings.

Advantages of the wealth creator’s strategy include:

- Helps you avoid draining your savings for purchases

- Allows uninterrupted compounding interest on saving

- Ability to negotiate on loan interest rates

- Savings increase as the loan is repaid and continues to earn interest

Uninterrupted compound interest works best in the long term. Moving interest-earning dollars from one account to another is not an efficient purchasing strategy. And the wealth creators understand that.

Schedule a Consultation to Help Create More Wealth

Did you identify your buying profile? Are you a saver, debtor, or wealth creator? If you think you need to improve it by making the most of your available resources, contact John Hunt of Raleigh. We will teach you how to become as efficient as possible while avoiding wealth transfer.

You will learn how to spend money wisely—to foster wealth creation, not depletion—and get out of debt. And it is easier than you think. Contact us today to discuss the relationship between owning life insurance and improving your purchasing efficiency.